Registration of Enterprises

To promote the growth of investments in the province, particularly in investment priority areas, the Bohol Investment Board shall review and approve appropriate fiscal and non-fiscal incentives grant to qualified investors and enterprises.

All enterprises intending to avail of the incentives as provided for in Bohol Economic Development and Investment Code (BEDIC) in the New Normal must be able to meet the following requirements:

- The business enterprise shall have complied with all the requirements mandated under existing local and national laws, and under the Philippine Constitution, including business registration requirements, accreditation requirements, as the case may be;

- The prospective investor’s place of operation or production shall be located within the Province;

- The prospective investment shall engage in any of the areas or activities cited in the investment priority areas, or, as may hereafter be declared by the Board;

- The new enterprise shall either be a registered Micro, Small, Medium or Large Enterprise, whether single proprietorship, partnership, corporation, or a cooperative, whose total fixed assets are defined in this Code, as stated in the Applicant’s project study submitted for approval by the Board;

- The new enterprise or project has not started its commercial operation;

- The new enterprise shall employ qualified bona fide residents of the Province equivalent to at least 60% of its total labor/manpower requirements; it shall submit a complete list of employees, or a Certification from the Public Employment Service Office in the LGU where the registered enterprise is located, that said requirement has been met;

- Expansion or modernization project shall have an additional project cost in the scale as provided for in this Code, and such expansion or modernization as stated in the investor’s project study submitted to and approved by the Board has not started its commercial operation;

- Foreign companies intending to apply for registration shall comply with the Foreign Investments Act, and project shall conform with existing law on the Foreign Investment Negative List; and,

- Project shall not negatively impact the environment, whether in terms of pollution, use of resource or easement.

Projects for Registration are categorized as follows:

- New Projects

- Expansion Project

- Modernization Project

- Green Business Project

An enterprise which intends to avail of the incentives provided for in the Code must meet the following qualifications:

- FILING FEE

An entity shall file its application for registration of a project with the Board through the Bohol Economic Development and Investment Promotion Office. A nonrefundable filing fee shall be paid to the Provincial Treasurer’s Office which shall issue an Official Receipt. The Official Receipt shall be submitted together with the application documents.

The filing fee shall be based on the amount of capitalization based on initial fixed assets of the business or enterprise, under the following scale:

Size of Enterprise | Filing Fee (P) |

Micro-scale Enterprise | None (0) |

Small-scale Enterprise | Five Thousand Pesos (P5,000.00) |

Medium-scale Enterprise | Ten Thousand Pesos (P10,000.00) |

Large Enterprise | Twenty Thousand Pesos (P20,000.00) |

- DOCUMENTARY REQUIREMENTS

The following documents shall be submitted to the Board through the Bohol Economic Development and Investment Promotion Office (BEDIPO) in three (3) copies:

FOR MICRO ENTERPRISES:

Single Proprietorship

- Copy of completed application form for registration under the Bohol Investment Code;

- Copy of Business Name Registration issued by the Department of Trade and Industry (DTI);

- Mayor’s or Business Permit, for expansion and modernization;

- Copy of the Certificate of Land Title if the enterprise owns the land or copy of the lease contract or agreement if leasing;

- Copy of the updated tax declaration issued by the city/ municipal government;

- Other documentary requirements as may be indicated in the application guidelines.

Partnership/ Corporation

- Copy of completed application form for registration under the Bohol Investment Code;

- Copy of the Articles of Partnership or Incorporation;

- Certified true copy of its Certificate of Registration, specific to the business applied for, issued by the Securities and Exchange Commission (SEC), for Corporation/Partnership;

- Mayor’s or Business Permit, for expansion and modernization;

- Copy of the Certificate of Land Title if the enterprise owns the land or copy of the lease contract or agreement if leasing;

- Copy of the updated tax declaration issued by the city/ municipal government;

- Resolution of the applicant’s Board of Directors, in case of a Corporation authorizing the filing of application;

- Other documentary requirements as may be indicated in the application guidelines.

Cooperatives

- Copy of completed application form for registration under the Bohol Investment Code;

- Copy of the Articles of Cooperation and By-Laws approved by the Cooperative Development Authority (CDA);

- Certified true copy of the Certificate of Registration issued by the Cooperative Development Authority (CDA);

- Mayor’s or Business Permit, for expansion and modernization;

- Copy of the Certificate of Land Title if the enterprise owns the land or copy of the lease contract or agreement if leasing;

- Copy of the updated tax declaration issued by the city/ municipal government;

- Authority from the Board of Directors to file the application;

- Other documentary requirements as may be indicated in the application guidelines.

FOR SMALL, MEDIUM AND LARGE ENTERPRISES:

Single Proprietorship

- Copy of completed application form for registration under the Bohol Investment Code;

- Copy of Business Name Registration issued by the Department of Trade and Industry (DTI);

- Mayor’s or Business Permit, for expansion and modernization;

- Copy of the Certificate of Land Title if the enterprise owns the land or copy of the lease contract or agreement if leasing;

- Copy of the updated tax declaration issued by the city/ municipal government;

- Copy of Audited Financial Statements (if existing);

- Environmental Compliance Certificate (ECC) or Certificate of Non-Coverage (CNC), whichever is applicable;

- Project profile or brief;

- Project study indicating the financial viability, socio-economic and environmental impact of the project;

- Comprehensive master plan for a project development of fifty hectares (50 hectares) or more, and corresponding project feasibility study;

- Other documentary requirements as may be indicated in the application guidelines.

Partnership/ Corporation

- Copy of completed application form for registration under the Bohol Investment Code;

- Copy of the Articles of Partnership or Incorporation;

- Certified true copy of its Certificate of Registration, specific to the business applied for, issued by the Securities and Exchange Commission (SEC), for Corporation/Partnership;

- Mayor’s or Business Permit, for expansion and modernization;

- Copy of the Certificate of Land Title if the enterprise owns the land or copy of the lease contract or agreement if leasing;

- Copy of the updated tax declaration issued by the city/ municipal government;

- Resolution of the applicant’s Board of Directors, in case of a Corporation authorizing the filing of application;

- Copy of Audited Financial Statements (if existing);

- Environmental Compliance Certificate (ECC) or Certificate of Non-Coverage (CNC), whichever is applicable;

- Project profile or brief;

- Project feasibility study/report and supporting documents indicating environmental and social acceptability, among others, including compliance with existing environmental laws, ordinances, and guidelines;

- Comprehensive master plan for a project development of fifty hectares (50 hectares) or more, and corresponding project feasibility study;

- Other documentary requirements as may be indicated in the application guidelines.

Cooperatives

- Copy of completed application form for registration under the Bohol Investment Code;

- Copy of the Articles of Cooperation and By-Laws approved by the Cooperative Development Authority (CDA);

- Certified true copy of the Certificate of Registration issued by the Cooperative Development Authority (CDA);

- Authority from the Board of Directors to file the application;

- Mayor’s or Business Permit, for expansion and modernization;

- Copy of the Certificate of Land Title if the enterprise owns the land or copy of the lease contract or agreement if leasing;

- Copy of the updated tax declaration issued by the city/ municipal government;

- Project study of the proposed investment indicating the financial viability and the socio-economic and environmental impact of the project;

- Comprehensive master plan for a project development of fifty hectares (50 hectares) or more, and corresponding project feasibility study;

- Other documentary requirements as may be indicated in the application guidelines.

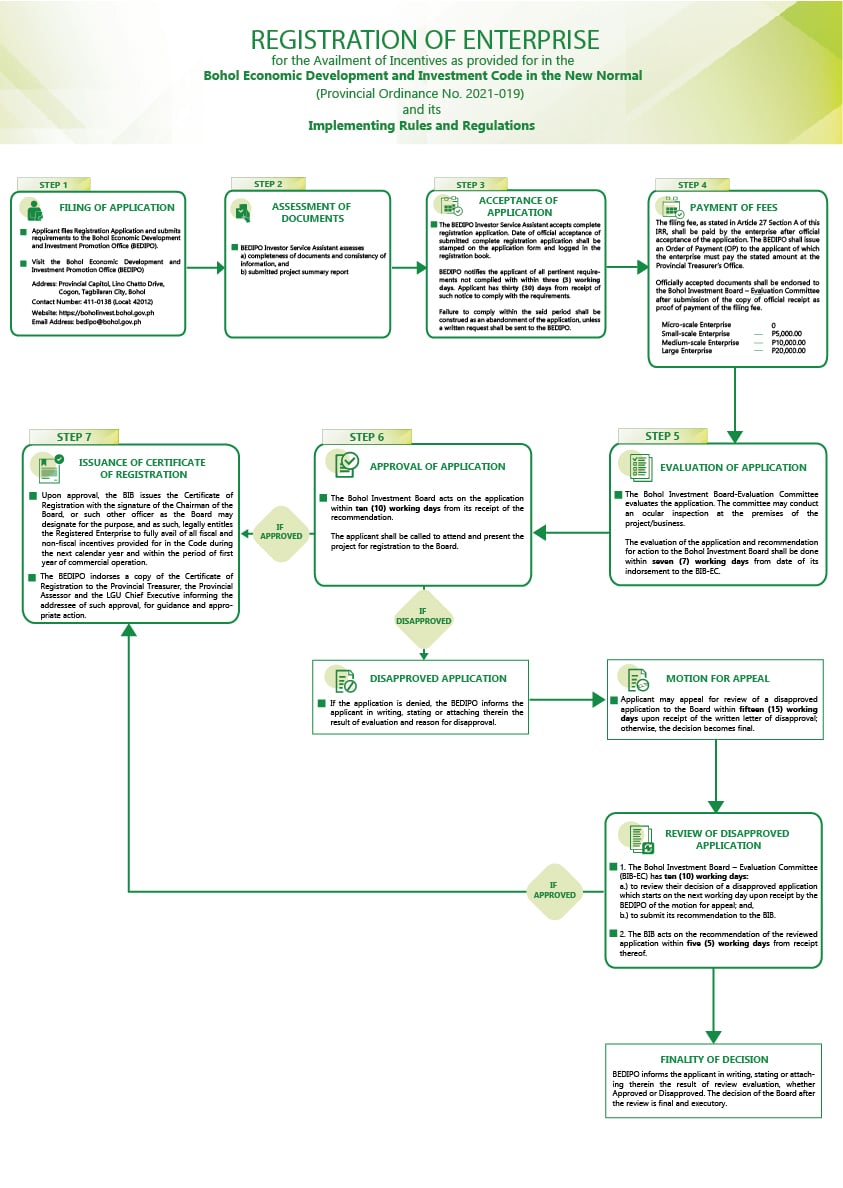

Registration of Enterprises Flowchart

Fiscal and Non-Fiscal Incentives

Tax Incentives to Registered Enterprises

In addition to the incentives provided under Republic Act 7160, otherwise known as the Local Government Code of 1991, Republic Act 7916 known as the Special Economic Zone Act of 1995, Executive Order No. 226 known as Omnibus Investments Code of 1987, Republic Act 9593 known as the Tourism Act of 2009, and other pertinent national laws, a registered enterprise under this Code shall enjoy the following tax incentives:

- Tax credit equivalent to ten percent (10%) of the total cost of approved infrastructure project to be deducted from the future real property tax liability of the registered enterprise from the Provincial Government starting from the date of the expiration of the real property tax exemption of the registered enterprise to cover for an extended period similar to the term of the holiday as specified; provided, that said infrastructure project shall be open for public use; and

- Exemption from the real property tax imposed under Provincial Ordinance No. 97-001, otherwise known as the Provincial Revenue Code of Bohol, for registered enterprises for a fixed period under the following categories; provided, that the tax exemption shall pertain only to the thirty-five percent (35%) share of the province:

| Size of Enterprise | Period of Holiday |

| Micro-scale Enterprise | One (1) year |

| Small and Medium-scale Enterprise | Three (3) years |

| Large Enterprise | Five (5) years |

Non-Fiscal Incentives to Registered Enterprises

Registered enterprises and investors shall be granted the following non-fiscal incentives:

- Provision of a one-stop business registration and assistance center for simplified procedures, such as: access to data and information, handholding and after- care, and networking with related agencies;

- Consistent advocacy and support for ease of doing business; and,

- Other non-fiscal incentives as may be determined by the Board.